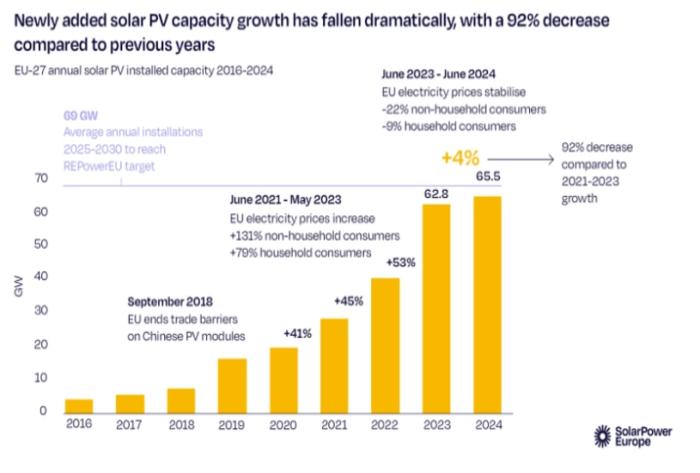

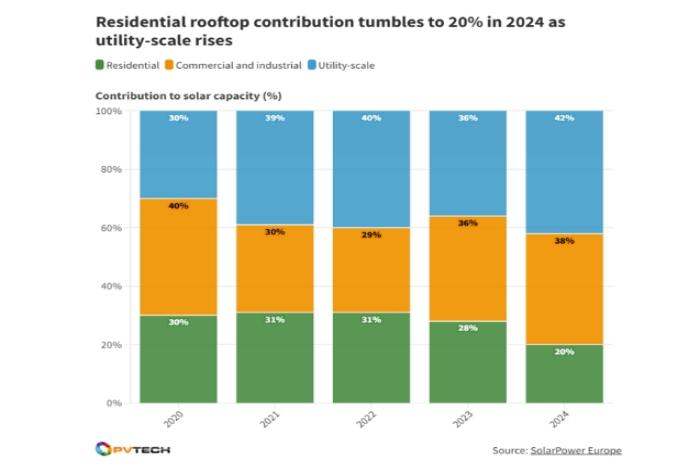

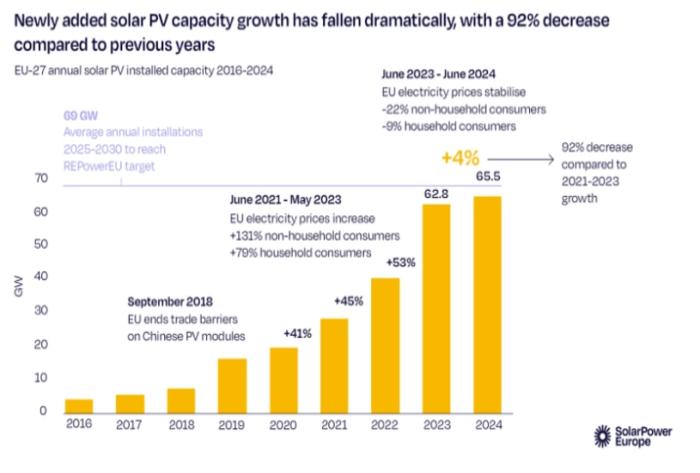

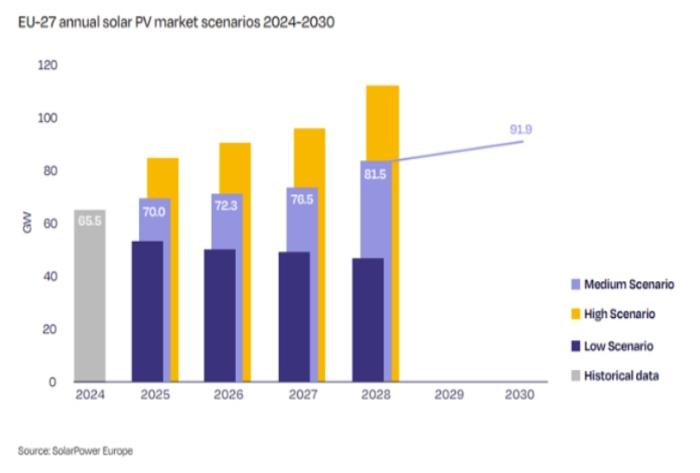

SolarPower Europe (SPE) released the "EU Market Outlook for Solar Power 2024-2028", The EU's new solar installed capacity will reach 65.5GW in 2024. Although the absolute value reaches a record high, the annual growth rate is only 4.4%, becoming the lowest growth rate since 2017. Rooftop photovoltaics dominate the newly installed capacity, adding 38GW, while centralized photovoltaics account for 27.5GW. By the end of 2024, the cumulative installed solar capacity in the EU has reached 338GW.

For SolarPower Europe, this slowdown comes as no surprise. “The solar market boomed during the natural gas crisis, but as bills returned to normal, public urgency for solar diminished,” the EU Solar Electricity Market Outlook report said.

Data from SPE shows that the residential rooftop market will decrease by nearly 5GW compared with 2023, with an additional 12.8GW added in 2024.

This decline is partly due to the removal of incentives for rooftop solar (for example, the Netherlands will remove its net metering scheme for household solar in 2027), which has resulted in Germany, Austria, Italy, Poland, the Netherlands, Belgium, Sweden, Spain and Hungary’s residential solar installations decline.

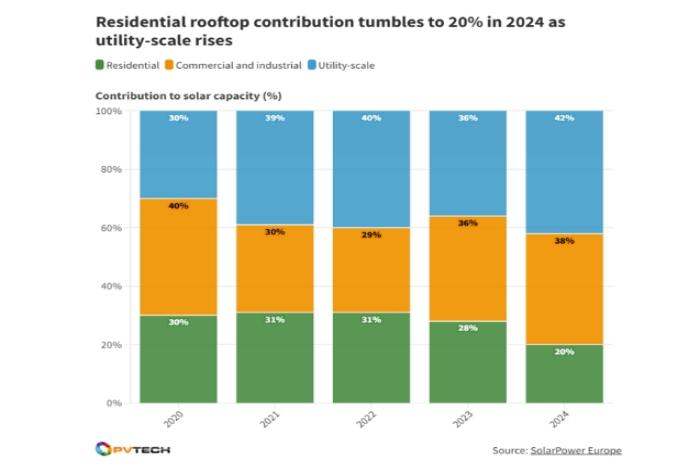

In 2024, the share of household solar energy will shrink to 20% from 28% last year.

Slowing growth in solar photovoltaics through 2024, coupled with stagnation in household solar power generation, is also affecting Europe's largest market.Half of the top 10 solar markets will see a decrease in new installed capacity in 2024 compared to the previous year. Solar PV markets have shrunk in Spain, Poland, the Netherlands, Austria and Hungary since the end of the energy price crisis, with policymakers failing to provide stable regulatory measures to sustain enthusiasm for solar investment.

The Netherlands has seen the largest decline, at 1.8GW annually since 2023, while the other five markets have seen "modest" growth, the report said. France will see the largest increase, adding 1.5GW in 2024.

Germany is expected to add 16.1GW of new photovoltaics in 2024, still the largest photovoltaic market in the EU, followed by Spain (9.3GW) and Italy (6.4GW).

Walburga Hemetsberger, CEO of SolarPower Europe, said: “European policymakers and system operators can view this year’s report as a yellow card. Slowing solar deployment means slowing Europe’s goals on energy security, competitiveness and climate.

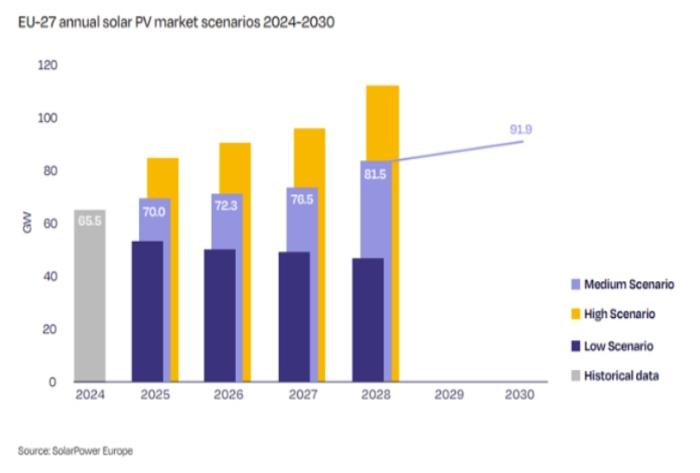

Europe needs to install around 70GW of capacity each year to meet its 2030 target – let’s consider corrective measures now before it’s too late. "

Looking to the future, the report predicts that photovoltaic power generation will still maintain single-digit growth from 2025 to 2028, between 3% and 7%.

SPE said this would still enable the EU to meet its PV capacity target of 750GW by 2030, as it expects to reach 816GW by the end of the decade.

In the report, SPE outlines several challenges facing the solar industry in the coming years. As mentioned earlier, the household market will continue to decline. However, the report highlights growing interest in balcony solar deployments. In Germany alone, more than 220,000 systems (approximately 800W) were added in the first half of 2024.

Inflexible European grids and constraints on cross-border capacity supply are major obstacles to large-scale ground-based power plants. Additionally, the EU’s slow rate of electrification (which has been stuck at 22-23% for the past five years) is a key reason for slower growth, according to SPE data. Accelerating the electrification transition in key sectors such as industry, heating and transportation will help promote the development of renewable energy.

The EU must drive the recovery and continued growth of the solar market through electrification and large-scale deployment of flexibility technologies